Breaking News

Finance

Bitcoin Nears $100K: Market Momentum or Mere Speculation?

Robert Tavares

March 8, 2024 - 19:21 pm

Bitcoin's Ascent to $100,000: A Plausible Dream?

In the ever-evolving landscape of cryptocurrency, a forecast that once seemed fanciful is now being looked at with earnest seriousness. The prediction of Bitcoin reaching the illustrious $100,000 mark is no longer a mere dream peddled by crypto zealots. Instead, it has found credibility within the mechanics of the options market.

The cornerstone of the digital currency realm, Bitcoin, shattered ceilings yet again, topping a zenith of over $70,000. This unprecedented rally saw a staggering appreciation of more than 70% within a concise frame of seven weeks.

Options Market Signals: Reading Between the Lines

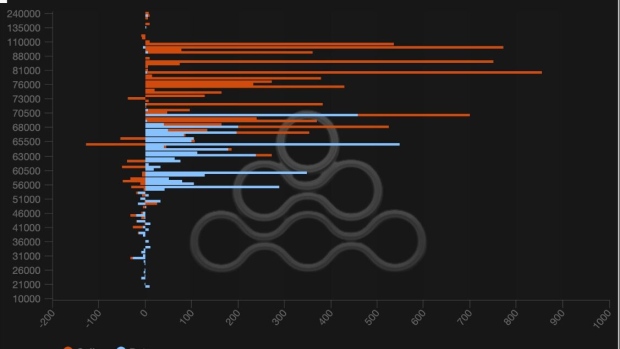

A closer scrutinization of the options market unearths pivotal data. Specifically, the open interest — a term that refers to the total number of unsettled contracts — for Bitcoin call options with strike prices at $80,000 and $100,000 witnessed an upsurge of approximately 12% each within a mere 24-hour period, as indicated by statistics organized by Amberdata.

"I think $80K by the end of the month is not crazy," proclaims Leo Mizuhara, the founder and chief executive of the decentralized finance institutional asset management platform Hashnote. "I just think the FOMO players are coming in soon. ETFs have opened up the space to even more retail."

In the midst of these shifts, experts are positing the potential of a rally more long-standing than the one previously experienced on Tuesday. The digital currency's breach of its late 2021 acme did ignite a fervor in the market, but there is a notable difference this time around. Analysts suggest that the most recent price hike was propelled by a concerted demand from the spot market rather than the derivatives market, which is generally marked by heightened leverage.

Retail investors, it appears, are increasingly inclined to purchase tokens directly from the cash market. In contrast, the derivatives market is known to offer options that amplify leverage, a tool not as commonly utilized by the average consumer.

The Healthier Market Pulse

"The current increase in Bitcoin's price appears to be more spot-driven since the market is much ‘healthier,’ with lower leverage compared to Tuesday," observes Luke Nolan, a research associate at the crypto asset management firm CoinShares.

A pertinent measure in this context is the annualized funding rate for Bitcoin perpetual futures on Binance. This rate is a vital signal for the level of leverage within crypto trading. At approximately 1:30 p.m. in New York, the rate stood at around 57%. Notably, this figure had skyrocketed to over 100% the preceding Tuesday.

An equally significant telltale sign was the drop in implied volatility for Bitcoin options, which occurred in tandem with the price taking a hit. The nosedive was immediate, following the currency's earlier victory lap after breaching its previous record.

Despite this, bullish sentiment and speculative buzz have maintained a stronghold, keeping leverage at a considerable height. The drawback, after hitting the $70,000 milestone, is partly attributable to a spate of liquidations permeating the derivatives market.

"Open interest is still sky high, and there's still rampant speculation," asserts Zaheer Ebtikar, founder of the crypto fund Split Capital. "This is generally the hardest part of the crypto cycle as hotter money comes in and pushes valuations the furthest but at the same time increases risk and volatility."

ETF Influx: Fueling the Rally

At the epicenter of the bullish upsurge is the unprecedented influx into the newly minted spot Bitcoin exchange-traded funds (ETFs). Since their inaugural trading day on January 11, these nine ETFs have seen a cumulative net inflow of roughly $10 billion.

"We are seeing some of the strongest flows," Nolan comments, noting the heightened activity.

This inflection point is emblematic of a greater acceptance and incorporation of Bitcoin within the mainstream financial fabric. The advent and resultant popularity of Bitcoin ETFs symbolize this seismic shift. Offering an avenue for traditional investors to partake in the potential benefits of digital currency without the associated complexities of direct cryptocurrency ownership, ETFs unravel a chapter of accessibility and regulatory compliance that further legitimizes the sector.

Looking Ahead: The Path to $100K

The influx of new participants, inspired by the surge and potentially heightened accessibility due to ETFs, adds a layer of fervent speculation and anticipation. As Bitcoin continues to etch new highs into the market's collective consciousness, the question on everyone's mind is whether the $100,000 frontier is a matter of when, not if.

Looming over this bullish outlook are the specters of increased risk and volatility. The influx of what Ebtikar refers to as "hotter money" underscores the emergence of individuals and entities looking for rapid gains but whose involvement may also engender price swings and instability.

Adding to the complexity is the unpredictable nature of regulatory movements. Governments and financial regulators around the globe are still grappling with how to manage, integrate, or potentially stymie the growth of cryptocurrencies. The decisions these bodies make could significantly influence Bitcoin's price trajectory and the broader adoption of blockchain technologies.

Prospects and Prognoses

Experts are cautiously optimistic but warn of the need for tempered expectations. While the market dynamics might support a push towards $100,000, the trajectory of Bitcoin is notoriously difficult to predict. Past performance is never a guarantee of future results, especially in the volatile ecosystem of cryptocurrencies.

Innovations and Integrations

The optimism is not unfounded, though. The crypto space is continually innovating, with DeFi platforms like Hashnote, pioneered by Mizuhara, aiming to institutionalize cryptocurrency investment strategies and enhance market maturity. These developments are integral to creating a more stable environment for long-term value appreciation.

Moreover, the integration of Bitcoin and other cryptocurrencies into payment systems, banking infrastructure, and fintech solutions continues apace. Each successful integration reinforces the value and utility of Bitcoin, pushing it further into the public and private sector economies.

Persistent Challenges

Yet, the allure of high returns is invariably entwined with the threat of sharp downturns. The crypto market's history is punctuated with booms and busts, and even the most ardent believers must navigate the turbulent waves with caution. The recent liquidations in the derivatives market that followed the price surge to $70,000 illustrate the precariousness of leverage in a high-stakes environment.

While current market conditions signal a healthier, less leveraged state, these conditions are not static. The confluence of market forces and sentiment can shift rapidly, often with little warning, and market participants must remain vigilant.

Navigating the Crypto Seas

For those looking to join the Bitcoin journey, the path is fraught with complexities. Understanding the nuances of the spot market versus the derivatives market, the implications of ETFs, and the interplay of market sentiment and technical indicators is paramount.

However, with astute observation, informed decision-making, and a measured approach to risk, the opportunities within the crypto realm are abundant. The market has matured significantly from its early days, but it remains an area where the bold can find reward, and the unwary can experience harsh lessons.

Conclusion: A Market of Possibilities

The fate of Bitcoin's charge towards the $100,000 mark rests on a delicate balance between innovation, market forces, regulatory landscapes, and the inescapable human emotions of fear and greed. The recent ascension serves as proof of its potential, but the path forward is uncharted and brimming with both promise and peril.

As the crypto community watches with bated breath, the next chapters of Bitcoin's saga will be written by a diverse cast of traders, investors, technologists, and policymakers. One thing is clear: Bitcoin has transformed from a niche digital curio into a significant financial phenomenon, and its journey is far from over.

Whatever the outcome, the narrative of Bitcoin reaching $100,000 will remain a poignant reflection of our times — a testament to human innovation and the ceaseless quest for financial sovereignty. Whether a reality or a reverie, it is a milestone that encapsulates the aspirations and anxieties of a digital age.

In the end, the story of Bitcoin is still being written, and its final chapters are sure to be as compelling as its meteoric rise.

©2024 Bloomberg L.P.

publishing perspective© 2024 All Rights Reserved