Breaking News

Finance

Economic Forecast: Inflation Slows, Retail Revival Fuels Market Optimism

Michael Chen

March 9, 2024 - 21:24 pm

Economy Watch: Inflation Eases, Retail Sales Bounce Back

(Bloomberg) - Recent economic indicators suggest a slow recession in U.S. inflation during the last month and a resurgence in retail sales, signaling the Federal Reserve's cautious stance on cutting interest rates. With the consumer price index's core measure displaying a slight uptick, the economic landscape presents a complex picture for policymakers.

Gradual Inflation Cool Down

The core consumer price index (CPI), which strips out volatile food and fuel costs to provide a clearer view of the trajectory of inflation, was observed to have increased by 0.3% in February, following a 0.4% rise at the onset of the year. The Labor Department is scheduled to release full data in its forthcoming CPI report this Tuesday.

Projections indicate that the CPI rose 3.7% from the previous year, which would signify the least substantial annual growth since April of 2021. Despite receding from the 6.6% peak recorded in 2022, the inflation rate's progression appears modest in recent months.

Federal Reserve's Caution

These developments resonate with Fed Chair Jerome Powell's recent congressional testimonies, wherein he acknowledged the likelihood of an eventual rate decrease "at some point this year," yet he emphasized that the timing is not immediate. The Federal Reserve aims to see convincing evidence that inflation is converging to their 2% target, a goal measured by another index, the personal consumption expenditures price index.

This week, additional data, including the government's producer price index, will be available to help inform the pivotal PCE index, which is expected after the Federal Reserve's policy meeting on March 19-20. Officials from the Fed are set to enter a blackout period, refraining from public commentary preceding this meeting.

Retail Sales Reinvigorated

Amidst a backdrop of persistent inflation, other signs of economic duress are scant. The latest employment reports indicate a moderation in job growth, yet they reveal enough vigor to sustain consumer spending. Sales in the retail sector are anticipated to show a 0.8% increase for February, overcoming a decline from the previous month. This resurgence suggests a revitalization of consumer activity post a robust holiday shopping season.

Other forthcoming U.S. economic data includes February industrial production figures and a preliminary consumer sentiment index from the University of Michigan for March.

Canada and Global Economic Forecasts

Turning to international outlooks, Canada's national balance sheet is poised to offer insights into household finances as borrowers grapple with heightened interest rates impacting mortgages.

Bloomberg Economists' report hints at the CPI for February unlikely to offer the convincing reassurance needed for the Fed to adopt a decisively dovish position. The timing of the Fed's rate cuts remains a contentious topic, with May or June marked as a potential window for action.

Read the full Bloomberg Economics Week Ahead for the U.S. here.

Global Economic Landscape

The upcoming week also holds attention for Japan, the UK, and regions spanning from Sweden to Brazil. Japan is set to disclose the results of its annual wage negotiations, which are expected to surpass the stellar outcomes of previous years. This could greenlight the Bank of Japan to terminate its negative rate policy. On the other hand, India's reports may display a quickened pace in industrial output with an anticipated cooling in inflation.

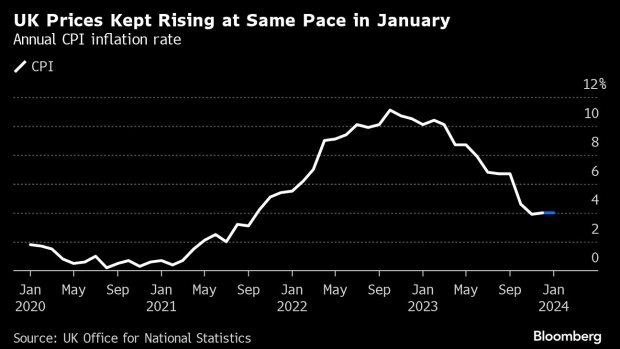

Developments in Europe, Middle East, Africa

In the UK, the spotlight shines on wage data with forecasts suggesting robust increases that could raise alert for the Bank of England. The Bank itself had recently been compelled to adjust staff wages to reflect inflation rates. UK’s GDP figures are also up for release, likely illustrating minor growth following December's slump. In the Eurozone, the focus turns to industrial production, which may have witnessed a decline at the beginning of 2024.

A number of European countries, including Denmark and Romania, are scheduled to publish inflation data. In Africa, Egypt's inflation numbers are set for release after a substantial rate hike and currency devaluation, while significant financial data will also emerge from Nigeria and Angola.

Read the full Bloomberg Economics Week Ahead for EMEA here.

Latin America Eyes Economic Data

Latin American economic forecasts are in the spotlight as the Brazilian central bank's survey on economists indicates a downward trend in inflation expectations, albeit inconsistently over the next few years. Brazil, Mexico, Peru, and Argentina are all slated to report crucial data pertaining to industrial production, GDP-proxy, and inflation, which remain critical for shaping regional economic policy.

Read the full Bloomberg Economics Week Ahead for Latin America here.

Closing Perspectives

The comprehensive set of economic data and indexes due to be reported in the coming days serves as a crucial guidepost for the Federal Reserve and other central banks across the globe. With critical decisions on monetary policies looming, financial markets remain vigilant for any indicators that may signal shifts in the prevailing economic winds.

Amidst these updates, the market continues to survey the intricate interplay between fiscal adjustments and inflation trends, with the possibility of rate cuts on the horizon injecting a layer of anticipation into future economic strategies.

Analysis from Bloomberg Economists

As the economy wades through the streams of fluctuating data points, analysts from Bloomberg Economics offer their perspectives on the implications these figures may have on the Federal Reserve's positioning. Their analysis is an invaluable resource for understanding the subtleties of economic indicators and their potential influence on the broader financial landscape.

For their full analysis, click here.

The Week Ahead

The global economic calendar remains dense with data releases poised to shed light on the current state of economic health worldwide. The picture that emerges will likely impact monetary policy directions in several major economies and steer investor sentiment across various markets.

As economic actors, from central bankers to investors, parse through the data deluge, the intricate mosaic of the global economic state progressively takes shape, holding broad implications for the near-term financial climate.

Conclusion

The economic narrative unravels a tale of tentative progress and persisting challenges. The Federal Reserve and its global counterparts stand at a crossroads, balancing the need for cautious optimism with the realities of measurable data. The week ahead is not just a collection of figures and percentages but is a chapter in the ongoing story of global economic vigor and volatility.

©2024 Bloomberg L.P. This document provides a forward-looking scrutiny of the economic indicators that continue to shape market expectations and central bank policies. The intersection of inflation data, industrial output figures, and consumer sentiment across various geographies paints a complex yet insightful portrait of economic resilience and adaptability in a fluctuating financial environment.

publishing perspective© 2024 All Rights Reserved