Finance

Unprecedented Global Debt Crisis Looms as Bond Markets Brace for Impact

Michael Chen

March 8, 2024 - 04:33 am

Mounting Debt Challenges: Global Bond Markets on High Alert

In a world where economic landscapes are shifting rapidly, the global bond markets have recently been highlighted in a report that sets the stage for significant unrest. Authorities have projected that a staggering amount of debt, approximately 40% of which is maturing in the next three years, is posed to be a monumental hurdle for governments and corporations worldwide. This comes as part of a forecast by the esteemed Organization for Economic Cooperation and Development (OECD).

A Record High in Government Debt

The OECD, a cornerstone for international economic collaboration, released a report on Thursday that paints a concerning picture of government debt levels. Member countries are bracing for an increase in total government debt, anticipated to soar by $2 trillion, thus reaching an all-time high of a jaw-dropping $56 trillion this year. The stability of economic structures across the OECD's 38 member countries hangs in the balance as these entities grapple with this escalating debt burden.

The Era of Affordable Borrowing Nears Its End

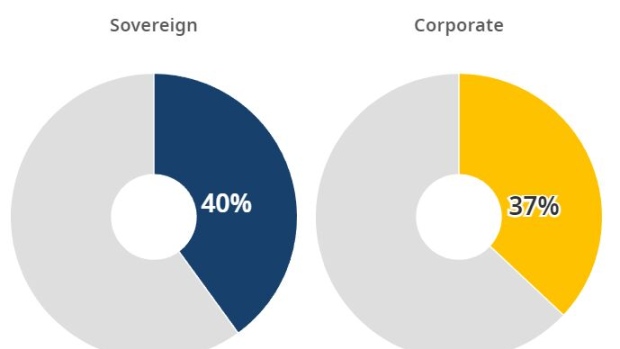

For years, governments and corporations have been beneficiaries of an environment that allowed them to accumulate debt without the added pressure of overwhelming costs. The period sprawling from 2008 to 2022 has been characterized by exceptionally favorable conditions for borrowing, thanks to which low costs were maintained. However, this report from the OECD starkly highlights that the days of economic ease are quickly diminishing. A significant chunk of global debt, comprising almost 40% of sovereign bonds and 37% of corporate bonds, will approach maturity by the year 2026.

This impending maturity presents a daunting reality. As these issuers seek to roll over their debt, they are very likely to encounter heightened borrowing costs. This remains a certainty, regardless of central banks' success in taming the prevailing inflation, which has been a global struggle.

The Central Banks' Changing Role

In a turn of events, we find central banks—once dominant players in the bond markets—reducing their stakes in bond holdings. Consequently, investors who are particularly sensitive to price changes are left to shoulder the burden, absorbing a net supply that is anticipated to reach unprecedented levels. This marks a shift in the dynamics within the bond market, transferring more risk to price-sensitive entities.

Transformative Times in Bond Markets

The OECD's Secretary-General, Mathias Cormann, has voiced his perspective on the evolution of the bond market, noting that we are witnessing a degree of transformation that is unparalleled in recent decades. According to Cormann, this new economic landscape, marred by higher inflation and increasingly restrictive monetary policies, is rapidly reshaping the bond markets on a global scale.

Market supervisors are now faced with the critical task of closely monitoring the sustainability of corporate debt, as well as the encompassing exposures within the financial sector. This is an area that demands heightened scrutiny, given the potential ramifications that could ripple through the economy.

The Specter of a Negative Feedback Loop

A dire warning has been issued by the OECD, particularly to several of its members who bear the burden of hefty debts. These countries may encounter a pernicious cycle—a negative feedback loop—that consists of a triad of financial woes: sky-rocketing interest rates, sluggish growth, and ballooning deficits. Addressing this looming threat requires proactive measures to prevent economic stagnation and financial instability.

Corporate Sector Debt: A Potential Point of Pressure

The OECD report has pinpointed the non-financial corporate sector as a critical area where risk-taking has surged notably. Here lies a potential focal point for pressure, especially considering the accumulation of debt within this area.

As of the conclusion of 2023, data indicates a precarious trend in the realm of investment-grade debt. A concerning 53% of such debt, emanating from non-financial corporations, has been assigned a BBB rating—this is the lowest rating among the high-quality tiers. Over the last two decades, the share of these ratings within the investment-grade corporate bond market has seen a drastic ascent, more than doubling since the dawn of the millennium.

This is not the only statistic that fosters unease. The proportion of BBB-rated bonds associated with high leverage scenarios—specifically those with ratios of debt to EBITDA (earnings before interest, tax, depreciation and amortization) exceeding a factor of four—has catapulted to 42% in 2023, a fourfold increase from a mere 11% in 2008. Clearly, the trajectory in terms of leveraging indicates an aggressive appetite for risk-taking that has burgeoned over the years.

The Implications of Potential Downgrades

The concerns are further augmented by the diminishing quality of what is labeled as investment-grade bonds. There looms a limited market capacity to assimilate a significant swell in supply of non-investment grade bonds. For the financial sector, and the economy at large, the ramifications of potential downgrades require careful contemplation. The landscape is such that even the smallest ripple could trigger overwhelming waves, heralding the requirement for preemptive considerations and strategies.

Given these acute threats to the stability of the bond market, and by extension the broader financial landscape, stakeholders are taking note of the pivotal observations made by the OECD. The organization emphasizes the need for vigilant oversight, strategic foresight, and a nuanced understanding of market conditions. As the Secretary-General calls for prudence, the global community finds itself at a crossroads, determining the best path forward amidst economic uncertainty and the eventuality of change.

© 2024 Bloomberg L.P.